SUBSCRIBE to the Fact of the Week

The maintenance of our highways has traditionally been funded from a combination of Federal and state taxes collected at the pump from the sale of motor fuels. Because electric vehicles (EVs) do not refuel at pumps that collect state and Federal fuel taxes, they do not contribute to the upkeep of the highways. This has caused many states to rethink how funds are collected to support the highway infrastructure.

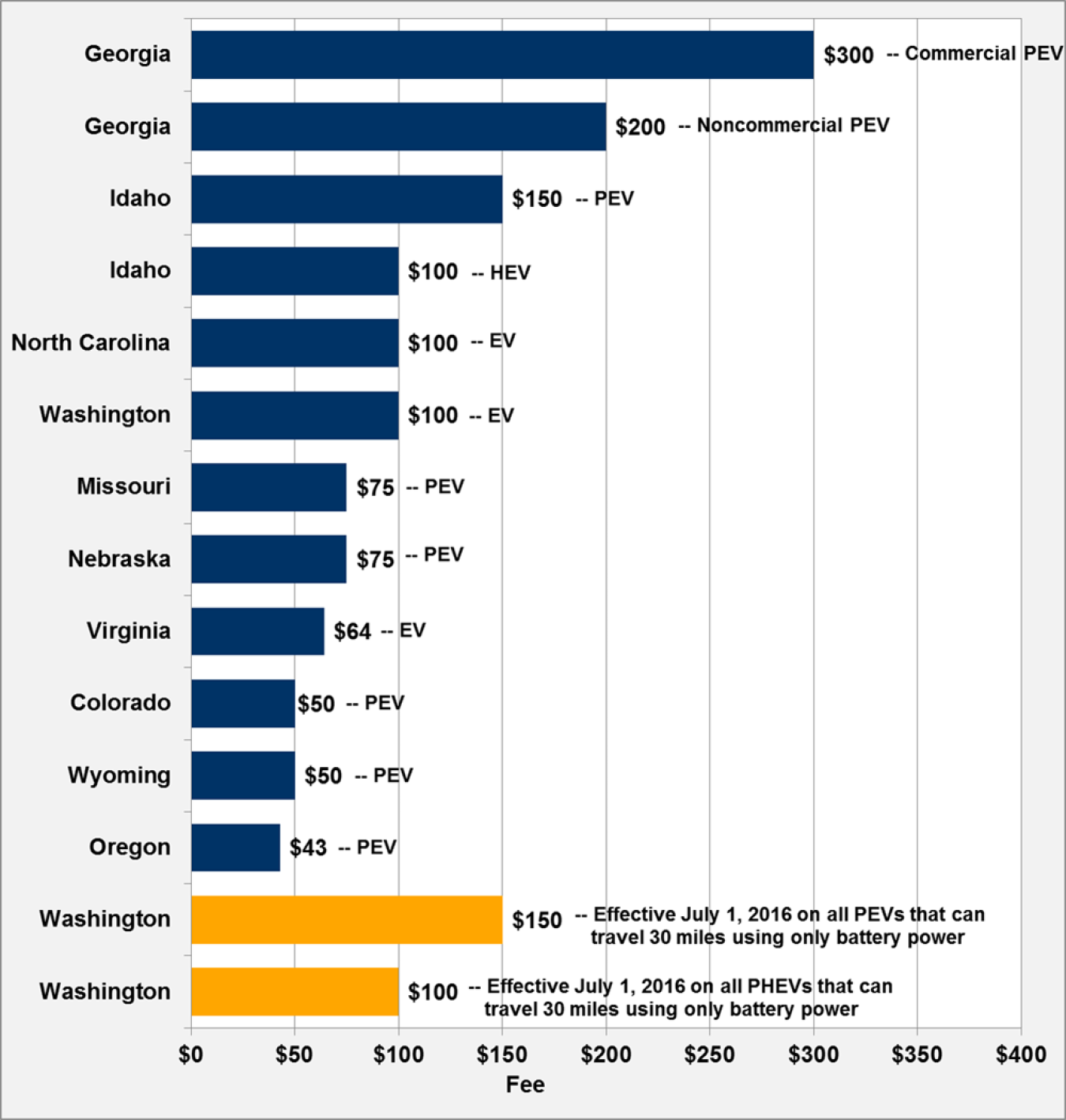

Nine states currently assess fees on electric vehicle owners in lieu of traditional fuel taxes. Georgia has the highest annual fee of the states that have currently enacted fees for electric vehicles. Commercial and noncommercial plug-in electric vehicles (PEV) have different fees in Georgia. Idaho is the only state that has a fee for conventional hybrid electric vehicles (without a plug). Washington State has enacted new fees that will become effective July 1, 2016.

Annual State Fees for Electric Vehicle Owners as of September 2015

Notes:

- EV = All Electric Vehicle

- PHEV = Plug-in Hybrid Electric Vehicle

- PEV = Plug-in Electric Vehicle (includes both EV and PHEV)

- HEV = Hybrid Electric Vehicle (no plug)

Supporting Information

| State | Fee | Upcoming Fee* | Applied to: |

|---|---|---|---|

| Georgia | $300 | Commercial PEV | |

| Georgia | $200 | Noncommercial PEV | |

| Idaho | $150 | PEV | |

| Idaho | $100 | HEV | |

| North Carolina | $100 | EV | |

| Washington | $100 | EV | |

| Missouri | $75 | PEV | |

| Nebraska | $75 | PEV | |

| Virginia | $64 | EV | |

| Colorado | $50 | PEV | |

| Wyoming | $50 | PEV | |

* Effective July 1, 2016, all PEVs that can travel 30 miles using only battery power have an additional $50 fee. | |||