LPO helped finance the first five utility-scale PV projects larger than 100 MW in the U.S. With Desert Sunlight now fully operational, all five projects are online, generating clean electricity and repaying loans. The initial investments made by LPO he...

Office of Energy Dominance Financing

February 9, 2015

In 2011, LPO issued loan guarantees to the first 5 PV projects larger than 100 MW in the U.S. An additional 17 projects have been financed since without loan guarantees.

LPO issued a $1.46 billion loan guarantee to Desert Sunlight, a 550-MW photovoltaic solar project located in Riverside County, California. | Photo courtesy of NextEra Energy Resources.

LPO issued a $646 million loan guarantee to Antelope Valley Solar Ranch, a 242-MW photovoltaic solar project located in Lancaster, California. | Photo courtesy of Exelon.

![Agua Caliente Plant[1].jpg](/sites/default/files/styles/full_article_width/public/Agua%20Caliente%20Plant%5B1%5D_0.jpg?itok=VkRBXZeT)

LPO issued a $967 million loan guarantee to Agua Caliente, a 290-MW photovoltaic solar project located in Yuma County, Arizona. | Photo courtesy of NRG Solar.

LPO issued a $1.2 billion loan guarantee to California Valley Solar Ranch, a 250-MW photovoltaic solar project located in San Luis Obispo, California. | Photo courtesy of NRG Solar.

LPO issued a $337 million loan guarantee to Mesquite Solar, a 170-MW photovoltaic solar project located in Maricopa County, Arizona. | Photo courtesy of Sempra.

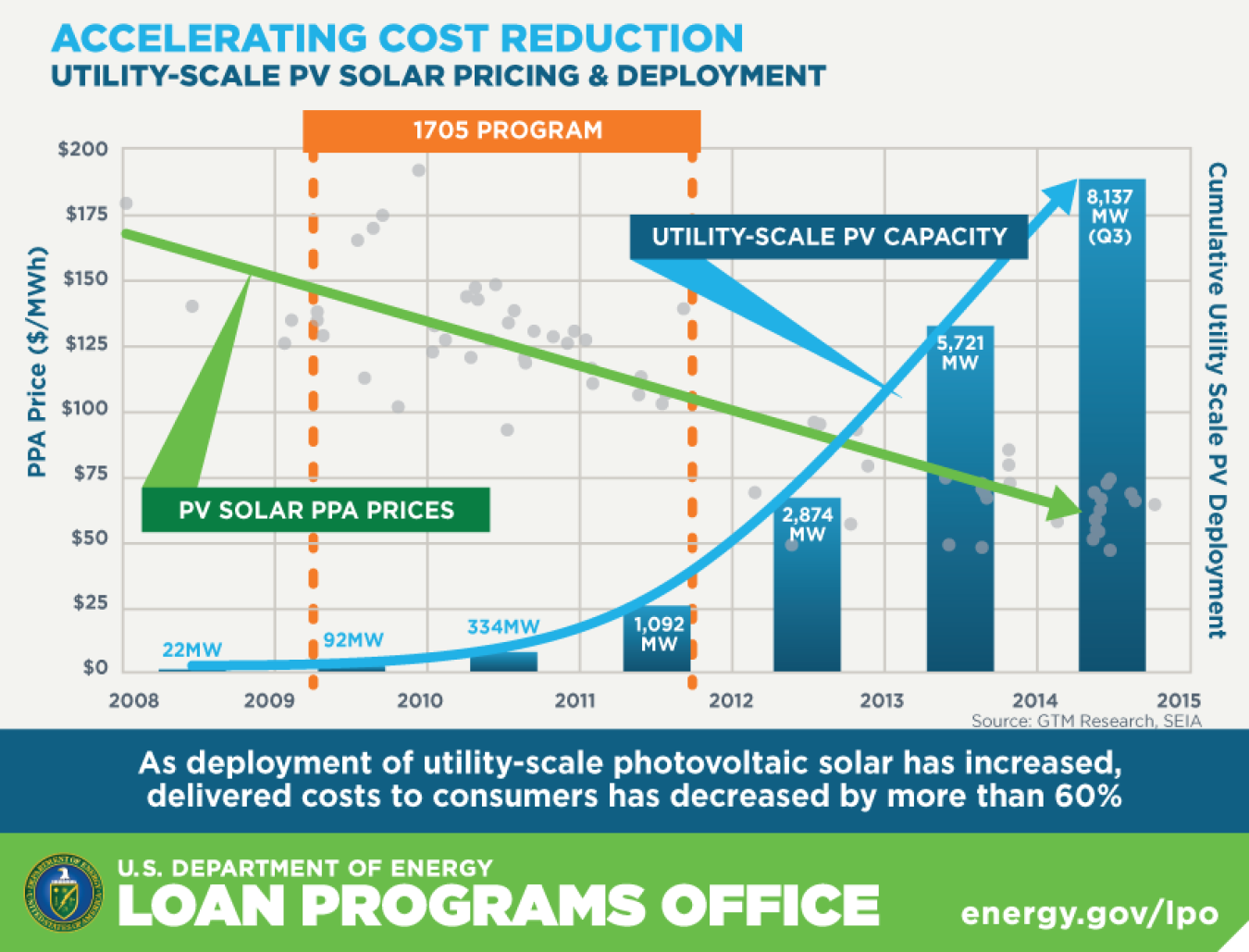

Between 2008-2014, the cost of power purchase agreements (PPAs) - essentially the price a utility pays a solar power plant for its energy - for utility-scale PV solar projects has decreased by more than 60%.

(Note: For updated information as of February 2016, please read this blog post from LPO Executive Director Mark McCall)

As President Obama noted in his State of the Union address, the U.S. brings as much solar power online every three weeks as it did in all of 2008. The Desert Sunlight Solar Energy Center being dedicated today alone represents nearly half of the solar power that was installed in all of 2008.

Project owners NextEra Energy, GE, and Sumitomo of America, along with technology provider First Solar, gathered this morning in Riverside County, California to celebrate the 550-megawatt (MW) project, which can claim to be the world’s largest photovoltaic (PV) solar power plant. It was constructed with the help of a $1.46 billion loan guarantee from the Department’s Loan Programs Office (LPO).

While the sheer size of Desert Sunlight is impressive on its own, the project represents something bigger for both LPO and the U.S. solar industry as a whole. As we detail in a new report about utility-scale PV solar, LPO helped finance the first five utility-scale PV projects larger than 100 MW in the U.S. With Desert Sunlight now fully operational, all five projects are online, generating clean electricity and repaying loans.

When most Americans think of solar, they probably picture solar panels on the roofs of homes and businesses. Utility-scale PV solar projects like Desert Sunlight use the same panels, but differ from rooftop installations in several ways. While a residential or commercial installer can only cover the typical roof with between .005 MW and 1 MW of electrical capacity, utility-scale projects are installed on the ground in open spaces with heavy direct sunlight and are generally larger than 5 MW. And while residential and commercial solar installations provide onsite electricity, utility-scale projects sell electricity to the grid the same as a coal, nuclear, or natural gas power plant.

But utility-scale solar wasn’t always part of our energy mix. At the start of 2009, no utility-scale PV solar projects larger than 100 MW existed in the U.S. and only 22 MW of utility-scale PV solar was installed in total. Nor was the sector expected to take off as residential and commercial installations were expected to lead industry growth. The U.S. Energy Information Administration (EIA) forecasted in 2008 that just 140 MW of total utility-scale PV solar capacity would be installed by 2015.

Now we’re in 2015 and Desert Sunlight itself represents four times more utility-scale PV than the EIA predicted for the entire industry just seven years earlier. So what changed?

First, policies at the federal and state level created more demand for large PV projects. Project sponsors were prepared to make significant investments in these projects and electric utilities signed long-term contracts to purchase the electricity if the facilities got built. However, commercial lenders were not willing to provide the necessary loans to fully finance construction of these projects largely because projects had never been built at that large a scale in the U.S.

To bridge this financing gap, LPO provided loan guarantees for the first four projects larger than 100 MW that allowed the project to be financed exclusively through the U.S. Treasury’s Federal Financing Bank. For Desert Sunlight, LPO worked with a group of 14 commercial financial institutions through the Financial Institution Partnership Program (FIPP) to jointly finance the project.

As required by law, LPO stopped issuing new loan guarantees under the Section 1705 Program on September 30, 2011. However, the initial investments made by LPO helped build a market that subsequently financed an additional 17 projects larger than 100 MW without help from the Department. Many were financed by the banks that gained valuable experience working with LPO on Desert Sunlight.

These privately financed projects include the recently completed Topaz Solar Farm, which can share a claim with Desert Sunlight as the largest PV installation in the world. Dozens of smaller utility-scale PV projects with capacity less than 100 MW are now powering communities across America. Today the U.S. has more than 8,100 MW of utility-scale PV solar capacity – enough to power nearly 1.4 million average American homes.

The initial financing provided by LPO helped transform U.S. energy production in a way few could have predicted in 2009 and paved the way for the fastest growing sector of the solar industry. The rapid growth of solar is lowering costs for consumers, creating jobs, and cutting harmful emissions that cause climate change.

The utility-scale PV solar story gets to the heart of what we aim to do at LPO – help launch new markets. To provide more details on this story, we released a new report today about the landscape for solar starting in 2008 and how it has changed in part through LPO financing.

The story doesn’t end here. A number of innovative technologies are on the cusp of commercial development and we hope to have a similar impact on advanced fossil energy projects, renewable energy and efficient energy projects, advanced nuclear energy projects and fuel efficient vehicles and auto components.