Read more about how wind technology was deployed in distributed applications throughout the United States and abroad.

Wind Energy Technologies Office

August 18, 2014Small and distributed wind energy systems enable homeowners, businesses, and institutions to generate their own renewable, and cost-effective electricity. These systems are commonly used on residential, agricultural, commercial, government and industrial sites, and are connected either physically or virtually on the customer’s side of the utility meter to deliver onsite power or connected directly to the local distribution or microgrid to support local grid operations or offset nearby electric loads. Distributed wind systems can range in size from 1 kilowatt (kW) or smaller for an off-grid turbine at a remote cabin, to a 10kW turbine at a home, to one or several multi-megawatt turbines at a university campus or manufacturing facility.

An annual report released today by the Energy Department and the Pacific Northwest National Laboratory (PNNL) analyzes industry trends that are unique to distributed wind applications, detailing costs, numbers of deployments, performance, capacity factors, types of turbines used, application types, domestic and international markets, and market drivers and barriers.

Despite weaker domestic sales in 2013, U.S. small wind turbine manufacturers capitalized on growing international markets. On a capacity basis, exports from U.S.-based small wind turbine manufacturers jumped from 8 megawatts (MW) in 2012 to 13.6 MW in 2013, an increase of 70%. U.S. manufacturers exported to more than 50 countries. The top markets were: Italy, the United Kingdom, Germany, Greece, China, Japan, Korea, Mexico, and Nigeria. Also, 76% of U.S. manufacturers’ new small wind turbine sales, measured by capacity, went to non-U.S. markets, a substantial increase from 2012.

Consistent with the nation’s overall wind market, more than 30 MW of new distributed wind capacity was added in the U.S., representing an 83% decline from 2012 to 2013. Slower domestic sales of distributed wind systems can be attributed to stalled state incentive programs, expiration of the Federal Tax Credit for turbines bigger than 100 kW, and other factors. Although 2013 was an off year for domestic sales, manufacturers are optimistic about 2014 because of new long-term leasing options for distributed wind systems and increased adoption of small- and medium-sized wind turbine certification requirements. The American Wind Energy Association has reported that up to 130 MW of distributed wind capacity was already under construction at the end of last year.

Since 2003, nearly 72,000 wind turbines have been deployed in distributed applications spread across all 50 states, Puerto Rico, and the U.S. Virgin Islands, totaling 842 MW in cumulative capacity. The turbines installed last year were used for the following purposes: 40% residential, 26% agricultural, 20% commercial, and 14% governmental and institutional. Vendors and manufacturers were spread across 34 states.

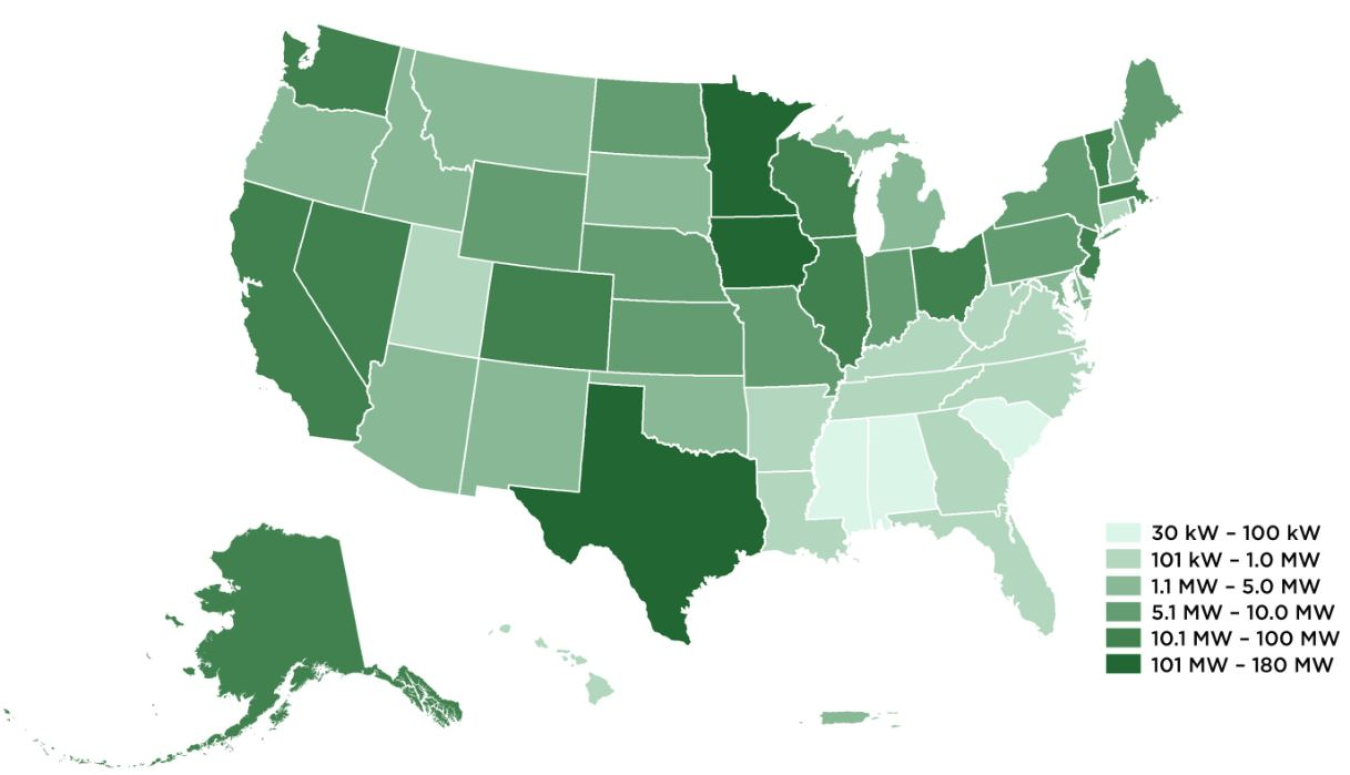

While distributed wind installations are increasing nationwide, Colorado, Kansas, Ohio, Massachusetts, and Alaska led the United States in new distributed wind power capacity additions in 2013 across all turbine sizes. Nevada, Iowa, Minnesota, Oklahoma, New York, Texas, and Hawaii installed the most small wind capacity. However, Texas, Minnesota, and Iowa retained their positions as the top three states with the most installed distributed wind capacity since 2003. A total of 14 states now each have more than 10 MW of distributed wind capacity.

2013 U.S. Distributed Wind Capacity Additions

Historically, adoption of distributed wind systems using small- and medium-sized wind turbines has been hindered by untested technologies, unverified claims about turbine performance, and equipment failures. To address this, the Energy Department’s Wind Program, in collaboration with industry, helped establish a process for small- and medium-sized wind turbine certification. Certification provides manufacturers a way to communicate third-party verified power performance, acoustic signature, and safety information about their products – boosting consumer confidence.

The Energy Department urges consumers to consider wind turbines that have been tested and certified for safety, function, performance, and durability. Also, the Energy Department encourages any public funds used in purchasing wind turbines should go towards certified systems to ensure taxpayer dollars are only made available to products with dependable performance estimates and demonstrated compliance with nationally recognized standards. As of June, national certification organizations have fully certified 13 small turbines and partially certified two medium-sized turbine models. The Energy Department is on track to reach its programmatic goal of increasing the number of certified small- and medium-sized wind turbine models from a 2010 baseline of zero to 40 by 2020.

The report released today reflects encouraging signs for the distributed wind industry, which is providing everyday Americans with renewable energy. Read the 2013 Distributed Wind Market Report in full for more insights.

Interested in powering your home or business using wind energy? Check out our small wind guidebook to get started. Also, watch our Energy 101 video to learn more about how wind turbines work.

MORE ON THE 2013 DISTRIBUTED WIND MARKET REPORT

- Go to energy.gov/windreport for additional graphics, video, and blog posts

- Download data from the report

- Participate in our live Twitter Q&A about wind energy