Appliances used in commercial buildings for cooking, cleaning, water heating, and other end-uses account for nearly 22 percent of annual commercial building primary energy usage. According to a new report from DOE’s Building Technologies Office, ener...

June 21, 2016

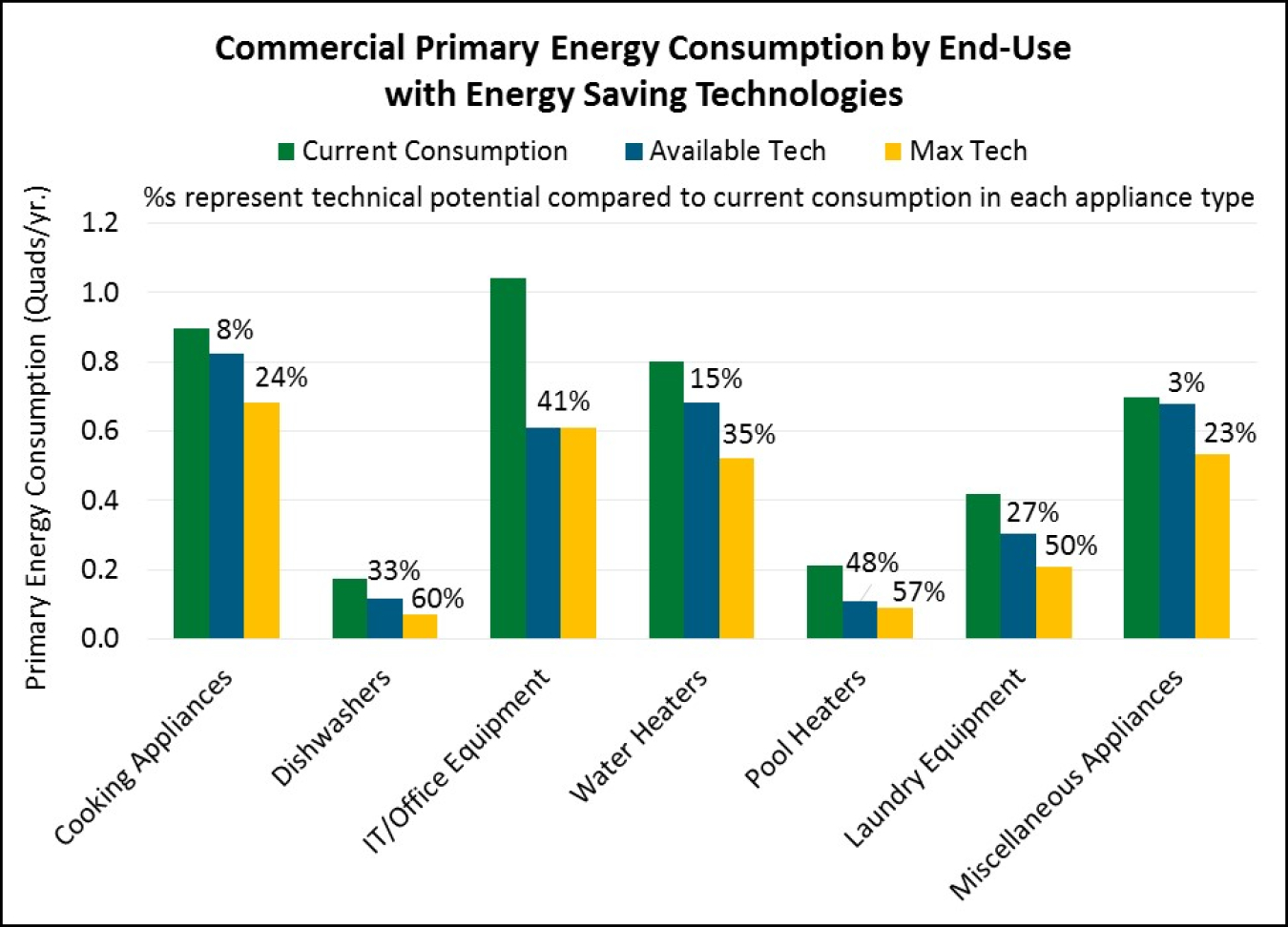

This chart plots the current primary energy consumption and potential energy savings for commercial end-use categories. Energy savings estimates reflect energy efficiency improvements over today’s baseline products meeting minimum efficiency standards. Actual savings may be higher as today’s standards are higher efficiency than typical installed equipment. Credit: Navigant

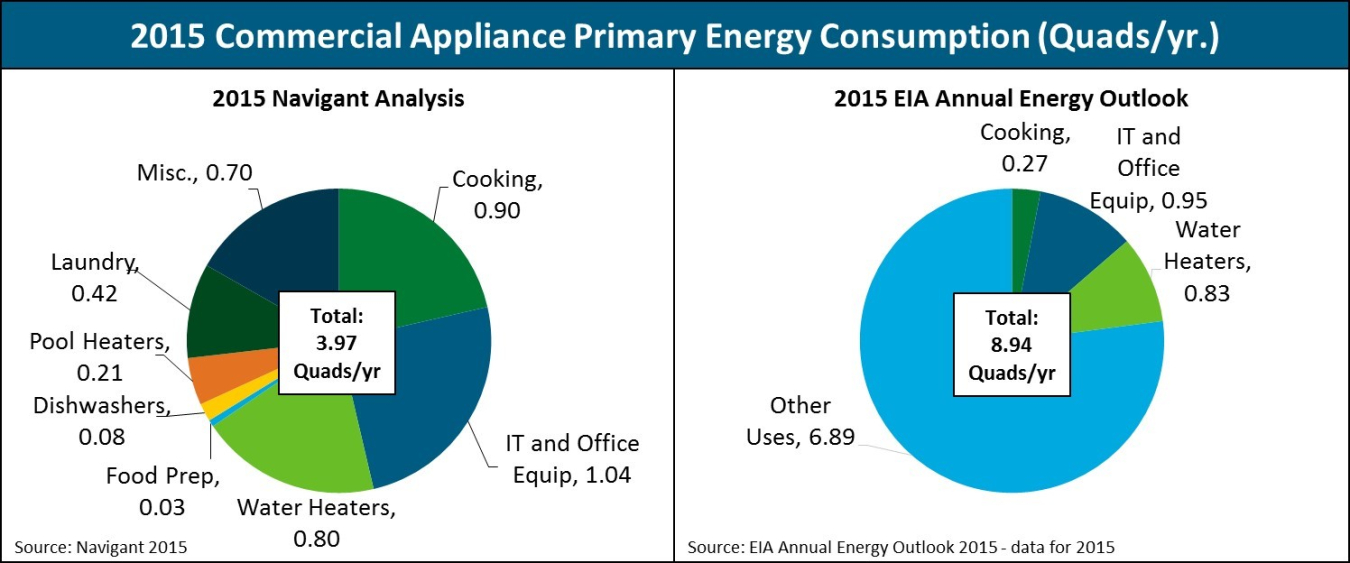

Note 1: 2015 Navigant analysis values for individual appliance categories do not sum due to overlap of hot water heating in both dishwasher and clothes washer operation, which is covered in the energy consumption for water heaters.<br /><br />

Note 2: The 2015 Annual Energy Outlook (AEO) reports commercial appliances consume 8.94 Quadrillion Btu, which is nearly 50 percent of annual commercial building energy consumption in the U.S. This number is more than double the consumption documented in this report, and is likely because AEO’s “Other Uses” category could include numerous additional equipment types, such as audio/visual equipment, telecommunications equipment, water distribution equipment, security systems, and other miscellaneous building loads that this study does not address.<br />Credit: Navigant

Download the report

Appliances used in commercial buildings for cooking, cleaning, water heating, and other end-uses account for nearly 22 percent of annual commercial building primary energy usage. According to a new report from DOE’s Building Technologies Office, energy-saving technologies available today could reduce commercial appliance consumption by 22 percent, with emerging technologies offering even bigger savings potential—36 percent.

The report, Energy Savings Potential and RD&D Opportunities for Commercial Building Appliances, documents energy consumption across eight commercial appliance categories and identifies research, development, and demonstration opportunities for improving their energy efficiency. A previous version of the report was published in 2009; the new report adds updated data using new sources and efficient technology options.

The 3.97 quads of primary annual energy consumption produced from commercial buildings estimated by the study is 36 percent higher than the 2.92 quads estimated in the 2009 report. Most of the eight commercial building appliance categories (cooking, food preparation equipment, water heaters, pool heaters, commercial dishwashers, commercial laundry equipment, IT and office equipment, and miscellaneous) showed higher energy consumption than they did in 2009, due in part to greater usage, inclusion of additional applications, and updated market data.

This study finds that technologies on the market today (i.e., available tech) could offer significant energy savings over meeting minimum efficiency standards or specifications. Examples such as highly efficient IT/office equipment, low temperature laundry detergents, ENERGY STAR dishwashers, and indoor pool covers are cost competitive with typical models, but require additional support to be adopted on a large scale.

Increased research, development, and demonstration (RD&D) activities could help these technologies fully penetrate the market by reducing installation, operation, and maintenance complexity, validating energy savings via field demonstrations, and marketing benefits to key stakeholders (such as utility energy efficiency programs and regional efficiency organizations). The U.S. Environmental Protection Agency’s ENERGY STAR and DOE’s Federal Energy Management Program (FEMP) could also help provide commercial building operators identify energy-saving opportunities and reduce project cost and complexity.

The report also examined emerging technologies—such as absorption heat pump water heaters, desuperheaters coupled with packaged HVAC equipment, and polymer bead laundry—all of which show large energy savings potential, but require further RD&D before their potential (i.e. max tech) can be reached. In these cases, RD&D activities would focus on proving technical performance relative to baseline technologies, reducing technology cost to decrease cost premiums and payback times, and facilitating connections between researchers, manufacturers, retailers, and system designers for successful product launch.