Homeowners weren’t the only ones affected by the economic downturn in Michigan. Because businesses were also looking for ways to reduce operating costs and save resources, the Michigan State Energy Program (SEP) worked with a nonprofit organization, Michigan Saves, to create the Michigan Saves Business Energy Financing (BEF) program. Using $5 million in seed funding from the U.S. Department of Energy's Better Buildings Neighborhood Program, the program targeted the retail food market as a way to help an industry historically underserved by energy efficiency programs.

Michigan Saves BEF worked to achieve energy efficiency upgrades in 2% of the commercial businesses in the state’s retail food sector. The program, which encompassed three distinct phases, began as a pilot project in Detroit focused solely on the retail food sector and ultimately expanded to include all commercial businesses across the state, seeking to help customers reduce energy use by at least 20%.

Defining Characteristics

Approaches Taken

Key Takeaways

What’s Next?

Additional Resources

Defining Characteristics

To remove barriers to commercial business energy upgrades, Michigan Saves formed partnerships with groups that had existing relationships with customers in the retail food sector, including the state’s utilities, trade associations, and building contractors, relying on the trust these partners had established with their customers to help promote the program and drive demand. Michigan Saves BEF focused on training a network of authorized contractors, who became the primary source for generating customer leads. The program ensured that contractors knew the program and its financing options well enough to walk customers through the upgrade process.

Through its partnerships with lenders, the program offered commercial customers below-market interest rates and flexible financing terms. With three distinct phases, including a retail food sector pilot project in Detroit, which was then expanded statewide, and finally opened to all small businesses across the state, the program was able to continuously evaluate and improve on its financing options and processes. Read more in the Michigan Saves BEF final report.

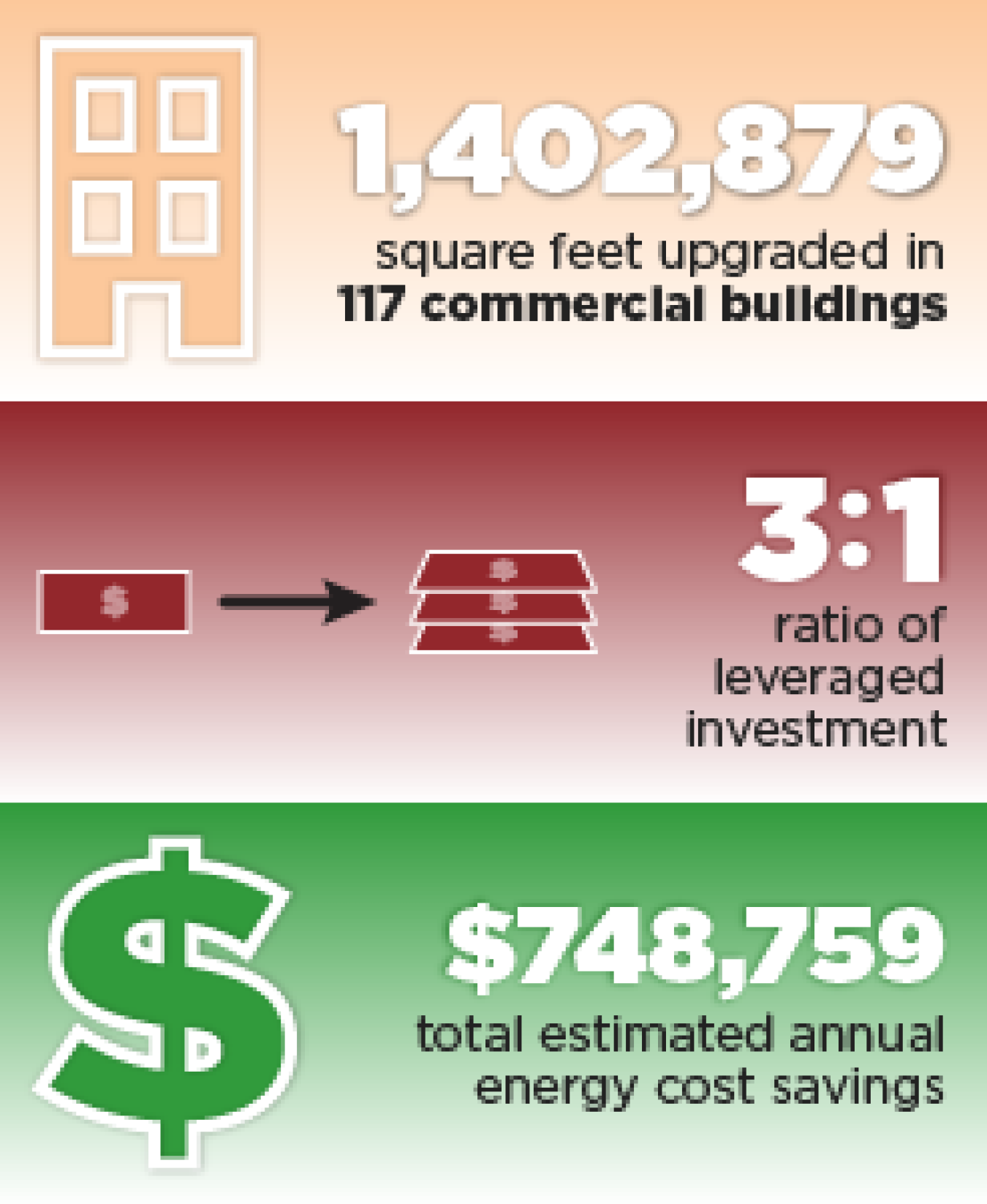

Accomplishments

(July 2010 to March 2014)

Approaches Taken

Using existing networks, utility resources, contractors, and trade associations, Michigan Saves BEF helped businesses finance energy upgrades, decrease operating costs, and achieve energy savings.

- Commercial Program Design: Michigan Saves BEF worked with an authorized network of contractors in all three phases of the program to promote the program and explain its financing options to businesses. In each phase of the program, after energy efficiency measures were installed, quality assurance reviews were completed to ensure the measures met program guidelines and, if not, corrective actions were taken.

- Phase I of the program was a pilot project in Detroit that targeted independent restaurants, grocery stores, convenience stores, and wholesale food vendors. The program helped fund energy assessments to determine where energy savings could be achieved and provided financing options to implement the recommended upgrades.

- During Phase II, the program expanded statewide to all businesses but offered special incentives in the retail food market and adjusted its financing terms and rebates to better serve customers. A program outreach coordinator served as the single point of contact for both contractors and customers and provided direct support, from assisting customers with questions about the application and upgrade process to informing contractors about resources and training opportunities.

- In Phase III, the program continues to serve all small commercial businesses in the state and expanded to include multifamily buildings.

- Marketing and Outreach: The program relies primarily on its contractor network to drive customer demand. Contractors were trained on all aspects of the program, including financing options, then used their networks, referrals, and word-of-mouth to develop the program’s commercial customer base. Trade associations, such as those in the retail food industry, also promoted the program to their members and included Michigan Saves staff at their events. State utilities provided information about BEF financing options on their websites and in materials. The program also utilized traditional advertisements in trade journals and on the radio to generate awareness.

- Financing: Through partnerships with financial institutions and a loan loss reserve, the program offered competitive interest rates and flexible financing options, making adjustments as needed to increase participation.

- In Phase I, the program provided businesses with $1,500 toward an energy assessment and loans up to $150,000 at a 5% interest rate and a seven-year term. For projects that were projected to decrease energy used by 20%, the program offered a special interest rate of 1.99%.

- In Phase II, flexible lease financing for energy efficiency equipment between $2,000 and $150,000 was added, as well as a $2,000 rebate for projects achieving 20% energy savings. The interest rate was adjusted to 1.99% for loans up to $75,000 and 3.99% for those greater than $75,000, and the loan application process was simplified to encourage participation. The rebate was later increased to $4,000. To achieve 20% energy savings, businesses typically installed indoor LED lighting, outdoor LED lighting, electronically commutated motors, and anti-sweat controls.

- In Phase III, the program increased the flexibility of its lending criteria and added a lending partner with leases up to $250,000. The program also offered commercial businesses interest rates buy-downs through partnerships with utilities, but only offered grant-funded incentives to those specifically in the retail food industry.

- Workforce Development: In order to offer the program’s financing to customers, contractors needed to be authorized, which involved applying to the program and attending a training webinar. Michigan Saves BEF offered authorized contractors reimbursements for classes on topics such as commercial energy assessments and provided biweekly trainings on program procedures and offerings. The program also provided training on energy efficiency opportunities specific to the retail food market, as a way to connect contractors with potential customers.

Key Takeaways

Through its three-phased approach, Michigan Saves BEF evaluated its efforts in each phase and used the results to improve program procedures and offerings. Lessons learned include the following:

- Have contractors and utilities help drive demand. Michigan Saves found that contractors were the most effective channel for generating customers, due in part to their pre-existing relationships with businesses. Staff trained contractors on program processes and financing options to help them promote offerings and assist customers throughout the process. Utilities helped promote the program in their materials and identify potential commercial customers.

- Simplify financing processes. While the loan product offered in Phase I was attractive, the application and approval process could take several weeks and, due to complex requirements, was daunting for business owners, who were more focused on managing day-to-day operations. In Phase II, the loan application was reduced to one page, and the time to process approvals decreased to one or two days, which made businesses more likely to apply.

- Adjust the program to meet the market’s needs. Initially, many of the program’s projects involved only one type of upgrade, which made it difficult to achieve 20% energy savings. To promote deeper energy savings, the program assessed the savings earned by various projects and realized that installing four measures—indoor LED lighting, outdoor LEDs, electronically commutated motors, and anti-sweat controls—often achieved a 20% energy reduction, so the program offered a $4,000 rebate to any business that implemented all four.

- Practice adaptive management. To ensure the program achieved its goals, Michigan Saves continually assessed progress towards meeting key targets and adjusted its design and processes when needed. This included: lowering the interest rate after Phase I; partnering with new institutions to offer more attractive financing options; and bringing on an outreach coordinator to support both customers and contractors.

What's Next?

Michigan Saves BEF achieved its objective of reaching 2% of the retail food market with energy efficiency measures. The program continues to be in operation and has expanded its scope to include public, multifamily, and residential sectors along with the commercial sector. Through its partnerships with financial institutions, Michigan Saves BEF is able to offer a self-sustaining financing program that includes low interest rates and loan products:

- To provide funding for Michigan Saves’ operations and support quality assurance measures, contractors now pay Michigan Saves a fee of $500 per project or 1% of the amount financed, whichever is lower.

- Looking ahead, the program’s plans for sustainability include increasing new loan activity by 10% each year, ensuring the loan loss reserve is sufficient, minimizing the rate of loan default, and continuing to charge contractor fees.

Additional Resources

Reports