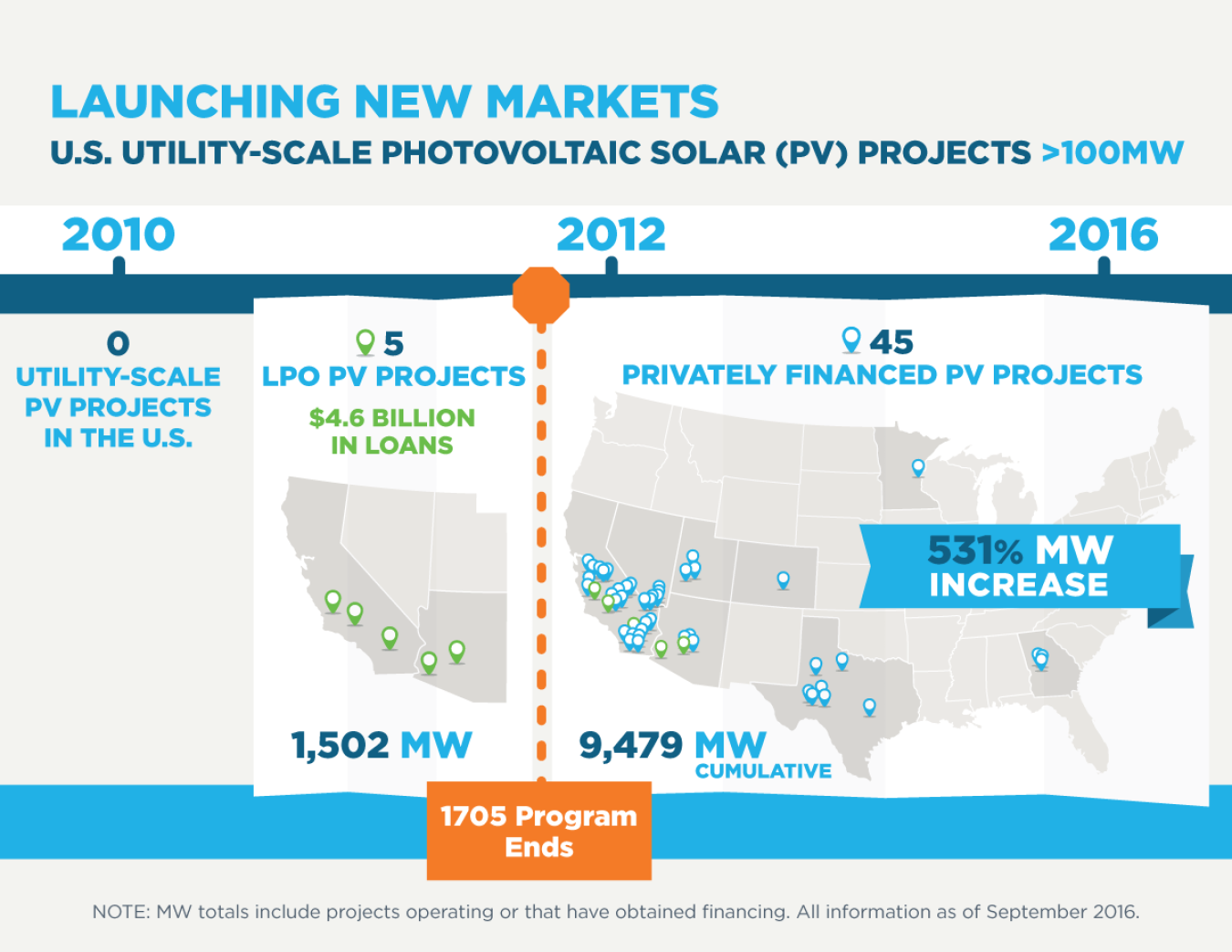

In 2011, LPO issued loan guarantees to the first 5 PV projects larger than 100 MW in the U.S. An additional 45 projects have been financed since without loan guarantees.

Today I participated in the ribbon-cutting ceremony at Mesquite Solar 3, a 150-megawatt (MW) photovoltaic (PV) solar project in Arizona that will help to power 14 U.S. Navy and Marine Corps bases in California. Mesquite Solar 3 is part of the three-phase Mesquite Solar Complex, which provides an ideal window into how the Department’s Loan Programs Office (LPO) helped launch the utility-scale photovoltaic (PV) solar industry in the United States.

In 2011, LPO issued a $337 loan guarantee to Mesquite Solar 1, the first phase of the Mesquite Solar Complex. It was one of the first five PV projects larger than 100 megawatts (MW) in the United States, all of which benefited from DOE loan guarantees under the Section 1705 Program, which was created by the American Recovery and Reinvestment Act (ARRA).

In the five years since LPO was required by ARRA to stop issuing new loan guarantees under the Section 1705 Program, utility-scale PV solar industry has taken off. The initial investments made by LPO in projects like Mesquite Solar 1 have helped build a market that subsequently financed an additional 45 PV projects larger than 100 MW in the United States without DOE loan guarantees. Included in those 45 projects are Mesquite Solar 3 and Mesquite Solar 2, which is expected to be completed later this year.

The initial five LPO-financed projects and the first 17 projects financed without loan guarantees were concentrated in the U.S. Southwest, as we first reported in February 2015. But as today’s update shows, the market has spread with strong growth in Texas and reached east to Georgia and north to Minnesota.

Seeing the 50 pins on a map representing the 100MW or larger utility-scale PV solar projects that have been financed in the United States since 2011 is awe-inspiring. But standing at Mesquite Solar 3 with the pioneering Mesquite Solar 1 in sight allowed me to see firsthand what LPO aims to do – help finance some of the first deployments of innovative technology, step aside, and then allow the private markets to take over. With approximately $40 billion in remaining authority to help finance advanced fossil energy, advanced nuclear energy, renewable energy and efficient energy, and auto manufacturing projects, LPO is working to replicate the success it had with utility-scale PV solar.