Once you have established your program's objectives, and identified potential financial partners, it's time for program administrators, financial partners, and other stakeholders to work together to design the financing program.

Identify Appropriate Loan Products

Design Sustainable Programs

Choose Your Program Structure: Credit Enhancements (step 4a)

Choose Your Program Structure: Revolving Loan Funds (step 4b)

IDENTIFY APPROPRIATE LOAN PRODUCTS

As a first step, identify the specific types of loan products that show the greatest market potential, based on your analysis in Step 1. For example, market-driven financing products help consumers at the time of purchase, such as in the middle of new construction or a major renovation, or when equipment needs to be replaced. If your analysis shows the potential for market-driven opportunities, the loan products you select for your program should allow for easy loan applications and quick approvals to enable spur-of-the moment purchases.

Also consider these loan product characteristics:

- Minimum/maximum loan amounts—This will limit the types of activities that can be undertaken with your program.

- Loan tenors—The length of a loan, from loan closing until its maturity.

- Fixed or floating interest rates—A fixed interest rate is one that remains the same over the length of the loan's term. Floating rate loans, also known as variable-rate or adjustable-rate loans, have interest rates that change over time. The conditions under which the loans change differ depending on the terms of the loan, but in general, the interest rates on these loans are tied to indexes.

- Customer capital contributions—A customer capital contribution is money the customer (or borrower) uses to increase equity interest in the service or product that the loan covers.

- Underwriting criteria—Underwriting is the process of determining whether an applicant is credit-worthy enough to receive financing. The traditional measures for evaluation are the applicant's debt-to-income ratio and credit-rating score, used by the credit-rating industry to represent credit worthiness based on bill payment histories, current debt, and other criteria. Proxies for credit, such as a utility bill or a property tax bill payment history, can also be used. One option is to include the energy savings on the income side when evaluating a borrower's credit using a debt-to-income ratio.

DESIGN SUSTAINABLE PROGRAMS

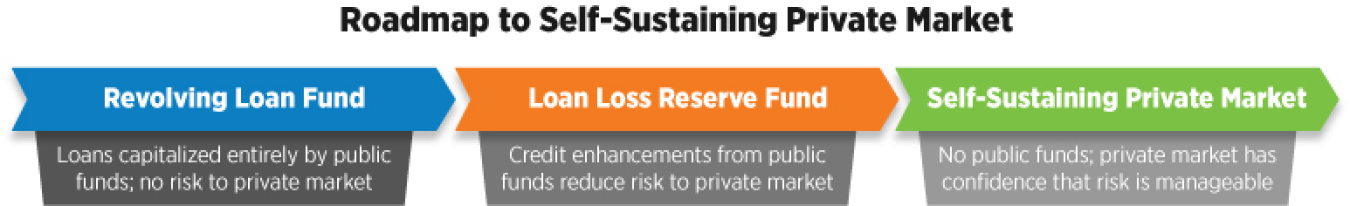

Be sure to design programs so that they can grow as the market matures. As the graphic below illustrates, sustainable programs might start off with substantial government support in the form of grants used to capitalize a revolving loan fund. Over time, however, strong programs progress and become self-sustaining. Program metrics, such as reserve rates indexed to the maturity of loans and proven default rates, are often used to automatically reduce reserve ratios to cover potential loan losses. This approach has the effect of increasing the amount of new loans or reducing public subsidies. It also ensures high-quality loan origination and servicing, as financial partners will have private capital at risk.

For more information related to sustainable financing programs, see Chapter 7 of DOE's Clean Energy Finance Guide for Residential and Commercial Building—Path to Self-Sustainability.

Financing programs typically include both credit enhancements and revolving loan funds before they become self-sustaining.

<< Previous: Financing Step 3 | Next: Financing Step 4a >>

KEY ELEMENTS OF LOAN TERM AND PRODUCT DESIGN

- Identifying eligible borrowers, projects, and measures

- Setting customer capital contributions

- Establishing point-of-sale loan applications with fast preliminary loan approval

- Setting minimum/maximum loan amount

- Determining length of time in which loans are due

- Establishing fixed or floating interest rates

- Identifying acceptable risk exposure

ENSURING QUICK LOAN APPROVALS

Pennsylvania's Keystone Home Energy Loan (HELP) program, a partner with EnergyWorks Philadelphia, works with multiple financial institutions to provide quick approval energy efficiency loans, often within two hours of receiving the application. So, for example, a homeowner whose furnace fails during winter can quickly finance a more efficient model without having to worry about pipes freezing while waiting for the loan application to be approved.